Improve retention and fortify your leadership pipeline by offering benefits that support employees during every life stage.

When Liz accepted her first job after graduating, she was 26, had no children, and wasn’t thinking beyond basic healthcare coverage.

Ten years later and she’s a highly valued member of the same organization. She’s also a married mother of three.

Liz’s life has drastically changed, and so have her needs as an employee, which is why her friends and family can hardly believe she’s been with the same organization for over a decade.

When asked the secret to her longevity, she responded, “It’s the benefits; they’ve supported me through each change I’ve made. I really lucked out because I had no idea how vital they would become when I started my career.”

Life Seasons for Benefits

Liz isn’t alone. Most employees value different benefits at different times. As workers progress through life, their needs and wants change, as does the support they seek from employers.

Companies can leverage this fact to build an inclusive and highly valued benefits package with cross-generational appeal by focusing on offerings that support employees during every season of their lives.

Not only will this help employers increase retention, but it will also fortify their leadership pipelines and bolster the employee experience.

What the Research Says

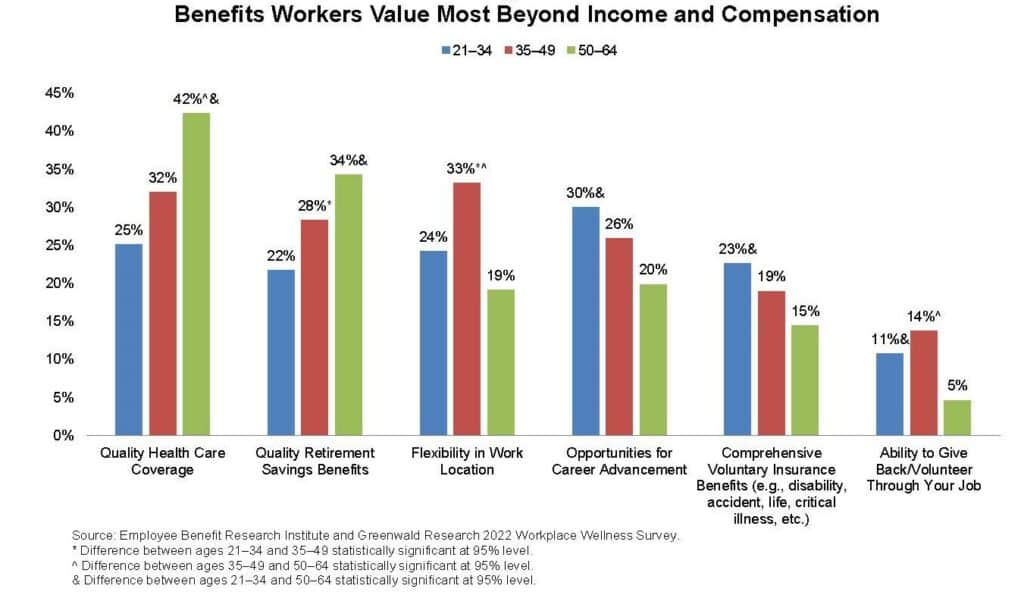

The Employee Benefits Research Institute (EBRI) 2022 Workplace Wellness Survey found that attitudes toward employee benefits largely differ based on age group.

The Employee Benefits Research Institute (EBRI) Workplace Wellness Survey

For instance, the survey found that middle-aged employees are more likely than younger or older workers to prioritize flexibility.

Unsurprisingly, older workers were focused on retirement benefits; however, young employees valued help with day-to-day bills, student loan debt assistance and career advancement opportunities.

With these results in mind, here are some benefits to consider offering your employees based on life stages.

New Graduates

Fresh out of school and just starting their careers, the primary concerns for this age bracket are upward mobility, professional development, student loans and basic living expenses.

EBRI’s survey found that younger employees are most likely to value opportunities for career advancement and that their most significant financial stressor is covering monthly bills.

Consider offering benefits like tuition reimbursement, professional development, and skill-building and mentorship opportunities.

Because basic finances are such a worry, expect cost to drive the decision-making process.

Family Planning

As employees grow into their careers and gain financial footing, many will start building families.

Employees who are parents or expecting parents highly value family-friendly benefits like comprehensive maternity and paternity leave policies, on-site child care, or backup child care services in an emergency.

At this stage of life, medical benefits like pre-natal and post-natal care become increasingly crucial, as do fertility benefits such as in vitro fertilization (IVF), intrauterine insemination (IUI), fertility medications, and diagnostic procedures.

The Sandwich Generation

Many mid-lifers find themselves sandwiched between caring for children and aging parents while balancing work demands, making it one of the busiest seasons of life. At this point, employees may need the most from their employers.

Balancing work and life can be particularly challenging, so it should be no surprise that middle-aged employees are most likely to value flexibility, according to EBRI.

To accommodate workers, employers should consider offering flexible work schedules, compressed work weeks, remote work options, or even sabbaticals.

Benefits aimed at helping caretakers of young children, older adults or dependents with disabilities are one of the most coveted offerings in the marketplace. Elder care benefits are rising in popularity as well.

Retirement on the Horizon

As employees get older and their golden years come into sharper focus, retirement benefits take on greater value, and physical health becomes a greater priority.

Employees in the 50 to 64 age bracket are most likely to value quality retirement savings benefits as well as comprehensive healthcare coverage, according to EBRI’s survey.

Most employers offer 401(k), 403(b) or a pension plan, but they can enhance those programs by making additional contributions to their employees’ retirement accounts. These contributions can help boost retirement savings.

Companies should shoot for a 4.5% match. The average 401(k) match nets out to 3.5%, according to the Bureau of Labor Statistics, however, older employees are most likely going to be looking for matches between five and six percent.

Affordable and comprehensive healthcare is also a highly valued benefit along with retirement savings.

Benefits With Cross-Generational Appeal

Set yourself apart from the recruiting competition by offering versatile benefits that support employees from every walk of life during every stage of life.

For instance, our clients leverage our employee concierge service as a work-life benefit, and workers of all ages utilize the service in the ways that suit them best. Employers love the service because it’s practical, easy to implement and cost effective.

Younger, cost-conscience employees love the service because it comes with a vast network of vendor discounts and retail memberships that can save them money.

And working parents and mid-life employees love the benefit because it saves time and helps them resolve work-life conflicts.

Companies can take the guesswork out of creating a highly valuable and inclusive benefits package that increases retention by seeking solutions to support employees during every season of their lives.

Layer benefits with programs or services with cross-generational appeal, such as perks that improve work-life balance.

Inclusive, relevant and timely employee benefits help companies attract and retain a diverse workforce, bolster the employee experience and fortify leadership pipelines.